New Creditworthiness Scheme Linked to NIN Welcomed, But Gaps Remain.

- Home

- New Creditworthiness Scheme Linked to NIN Welcomed, But Gaps Remain.

New Creditworthiness Scheme Linked to NIN Welcomed, But Gaps Remain.

The Tinubu administration has taken notable steps toward promoting financial inclusion, especially for young and economically disadvantaged Nigerians. One such initiative was the Nigerian Education Loan Fund (NELFUND), launched in 2024 to provide interest-

free loans to tertiary students, repayable after graduation. Despite concerns over alleged mismanagement, NELFUND had disbursed about ₦57 billion to nearly 299,000 students by May 2025.

Now, the government is preparing to introduce a new credit scoring system to assess the creditworthiness of Nigerian citizens. The National Orientation Agency (NOA), which has been leading public awareness efforts, said the scheme will be managed by the Nigerian Consumer Credit Corporation (CREDICORP).

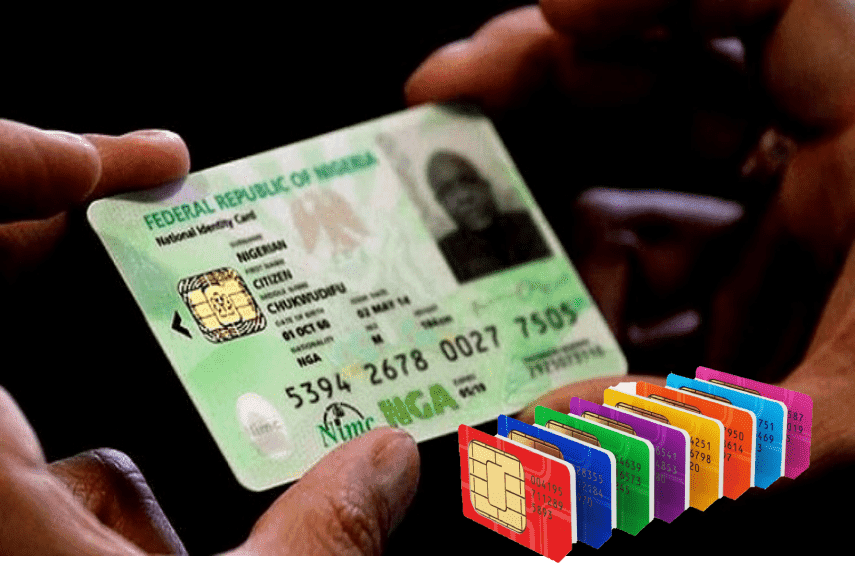

As part of the process, citizens will register online and link their National Identification Number (NIN) to their credit profile. Scores will range from 300 to 850, with higher scores reflecting stronger creditworthiness.

This is a promising initiative. It demonstrates a shift toward offering direct, measurable benefits to citizens. We believe such a system should be inclusive and made compulsory for all Nigerians, whether or not they plan to borrow. Establishing individual creditworthiness can give banks the confidence to extend loans without always requiring collateral. Personal integrity, reflected in a reliable credit score, could become a valuable form of collateral in itself.

A properly implemented credit scoring system could also enable federal and state governments to offer interest-free, collateral-free loans or palliatives to citizens and small businesses. This would be more transparent and efficient than past efforts like “conditional cash transfers,” which have often been marred by corruption.

The idea of linking this initiative to the NIN is, in theory, a positive step. However, the Federal Government has not effectively used NIN-related data to solve key national challenges, particularly in security. For instance, requiring citizens to link their NIN to SIM cards was intended to help track criminals and improve safety. That goal has largely gone unmet due to institutional failures.

We hope that with this new credit initiative, CREDICORP will avoid the pitfalls seen in past programs and deliver on its promise to improve access to fair and transparent credit systems for Nigerians.

Content & Editorial Manager – Leads the creation, review, and publication of high-quality news and media content. She ensures that all editorial work reflects the organization’s standards of accuracy, professionalism, and relevance, while also engaging and informing the audience.

As the key driver of TokinPoint Media LTD’s editorial voice, the manager oversees content planning, assigns tasks to writers or editors, enforces deadlines, and ensures consistency across all platforms. She also plays a strategic role in aligning content with audience interests and search engine optimization (SEO) best practices.

Discover more from TokinPoint

Subscribe to get the latest posts sent to your email.

- Share

Faith Kegh

Content & Editorial Manager - Leads the creation, review, and publication of high-quality news and media content. She ensures that all editorial work reflects the organization’s standards of accuracy, professionalism, and relevance, while also engaging and informing the audience.

As the key driver of TokinPoint Media LTD's editorial voice, the manager oversees content planning, assigns tasks to writers or editors, enforces deadlines, and ensures consistency across all platforms. She also plays a strategic role in aligning content with audience interests and search engine optimization (SEO) best practices.